Fantastic Capital Lease Cash Flow Example

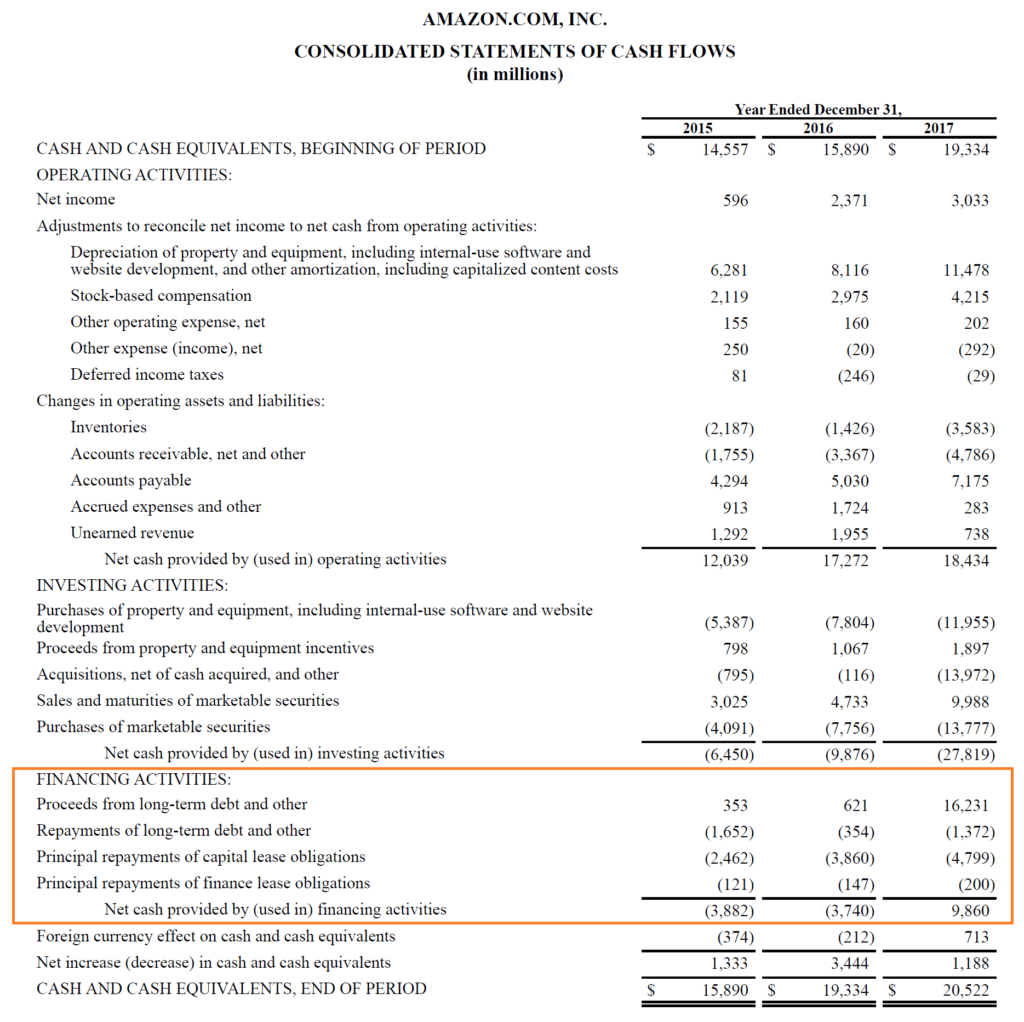

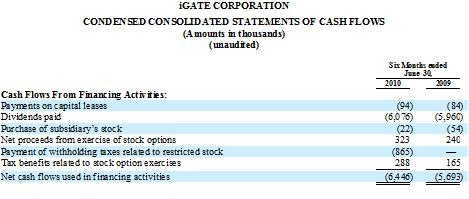

Cash flow from financing activities is the third component.

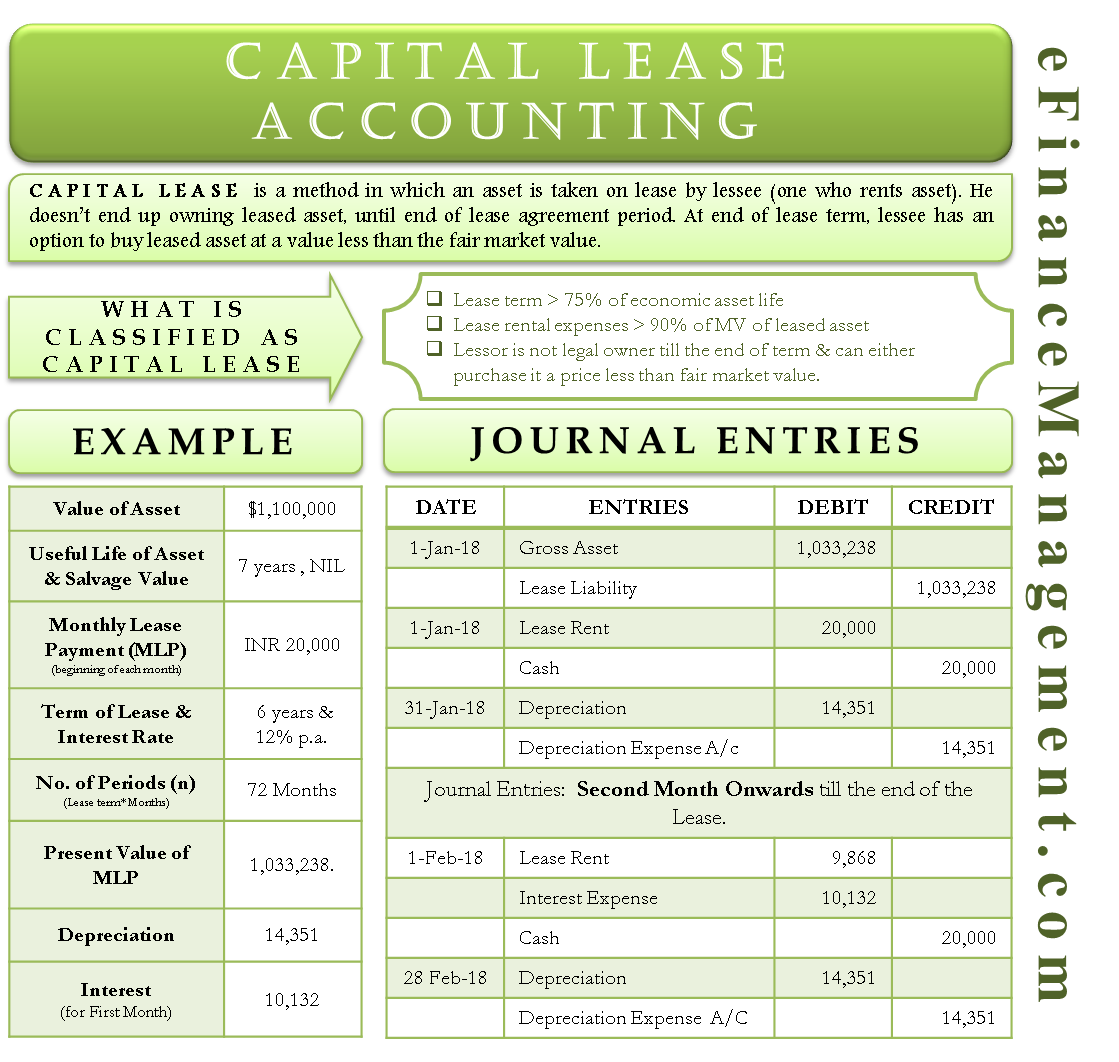

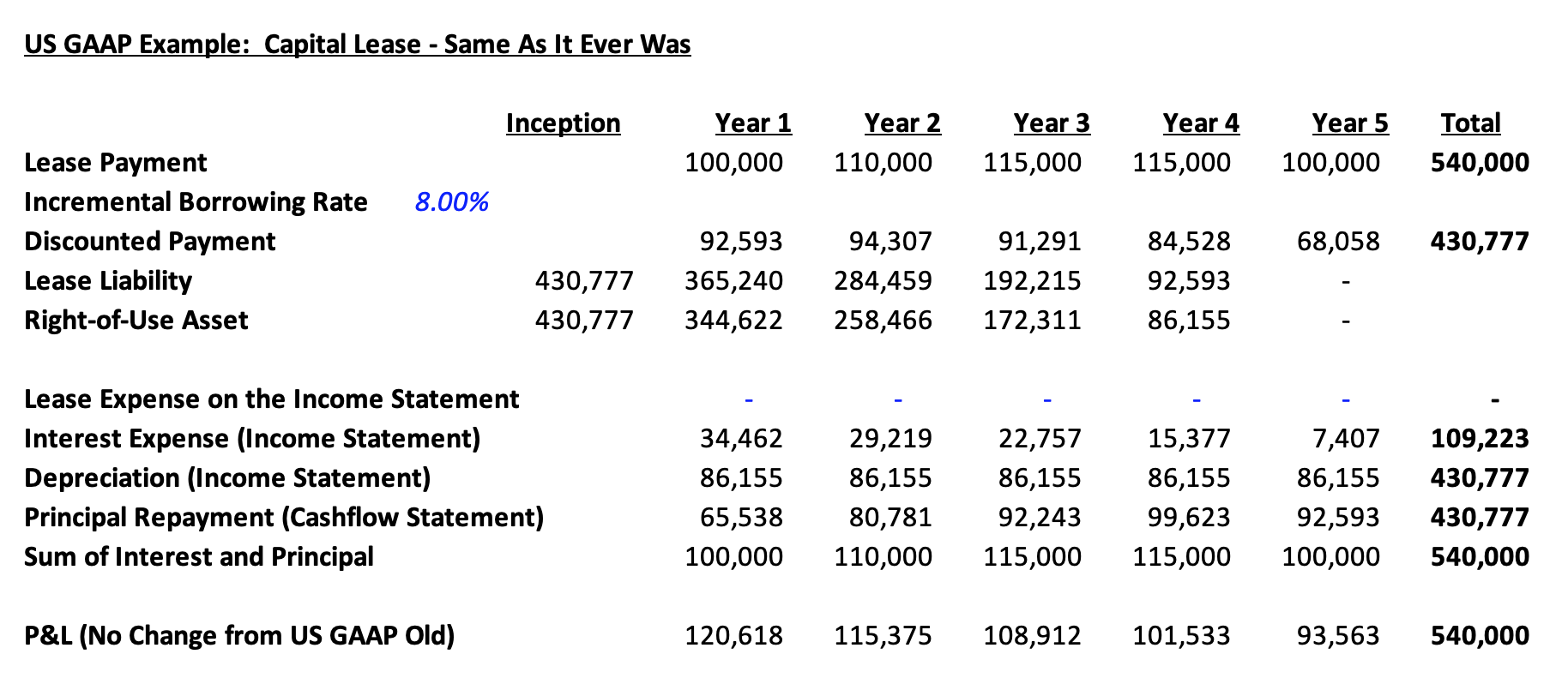

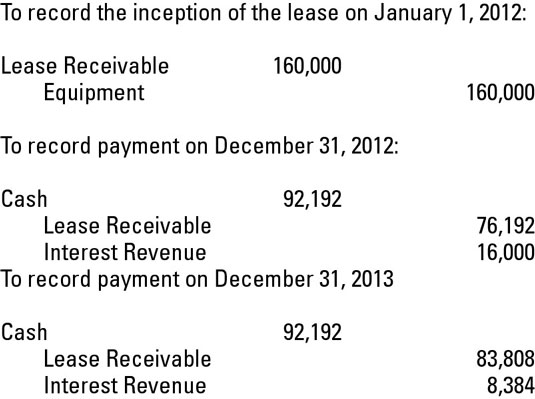

Capital lease cash flow example. Capital leases are counted as debt. You only need to make an adjustment if just one side of the transaction affects the cash flow subtotal. Pass the journal entries in books.

It is where we get cash from. Do note however that those payments are not shown separately but theyre part of either the operating results for the period or however youve called the line on the statement. On the face of the statement of cash flows finance lease payments are always shown under investing activities and operating lease payments are shown under operating activities as the name suggests.

To be classified as a capital lease under US. Financing can come from the owner owners equity or from liabilities loans. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain.

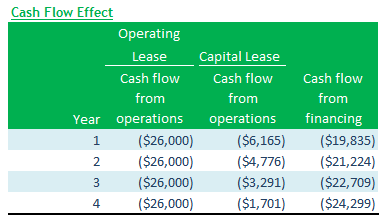

For example dont included in free cash flow both the effective capital expenditure and the lease rental payments in respect of capitalised leases. Current ratio and the quick ratio. A capital lease is an example of accrual accountings inclusion of economic events which requires a company to calculate the present value of an obligation on its financial statements.

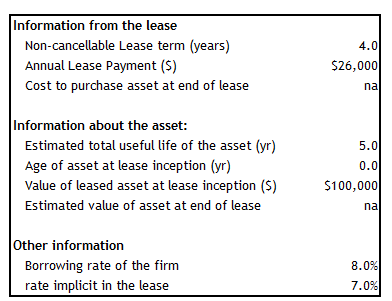

Thus financing activities mainly involves cash inflows for a business. However the tax shield is available only when company pays taxes. Suppose a business enters into a capital lease agreement for an asset worth 12000 and agrees to pay a deposit of 1500 leaving a balance of 10500 to be financed by a capital lease with an implicit annual interest rate of 7 requiring a further four annual rental payments of 3100.

Capital Lease Accounting Example. The loan amount to be repaid in each period the maintenance costs to be borne each year the tax shields associated with maintenance costs depreciation expense and interest expense. Figure out how much of the lease payments for the fiscal year were applied toward principal and interest.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)