Wonderful Cpa Certified Profit And Loss Statement

Is gross profit after expenses and before income tax is considered to be in line with previous financial years income level.

Cpa certified profit and loss statement. Lets explore the steps involved so you can easily compile an income statement when requested. If the Clients. The result is either your final profit if things went well or loss.

Externally or internally prepared Income Statements or Profit and Loss Statements signed dated and certified as to accuracy by applicant. Are they generally Certified or compiled by a CPA enough. Oftentimes the certified public accountant CPA who performs your general accounting andor bookkeeping and prepares your annual tax return can also prepare your financial statements and in addition perform the appropriate service in order to meet your banks requirements.

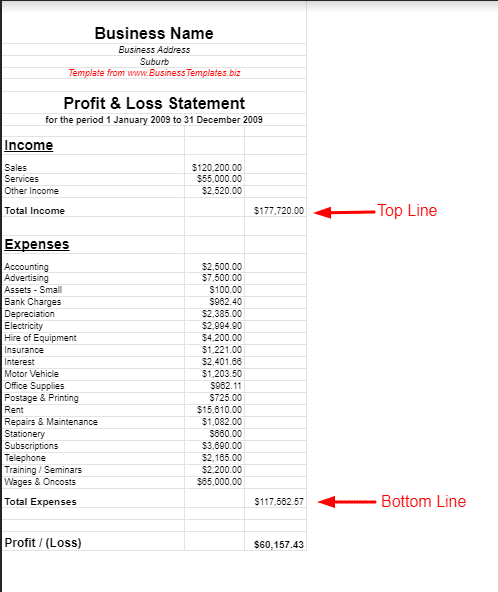

Suggested Wording for a CPA Comfort Letter. I am writing to you in response to a written request of my tax clients Mr. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time.

A certified public accountant CPA will audit the contents of these statements using generally accepted accounting principles GAAP to ensure the details are accurate. - Answered by a verified Financial Professional We use cookies to. A Certified Public Accountant CPA is an accountant who also meets the educational and experience requirements of the state they live in and has passed that states Uniform CPA Exam.

Certified statements including balance sheet profit and loss statement and cash flow statement are thoroughly audited by a CPA to ensure. CPA owners can also make significantly more than non-CPA owners with a 20 to 100 per hour price difference between the two. The income stated by the applicant John Smith on the self-certification form of 100000 pa.

They do bookkeeping financial planning and prepare financial documents like tax returns and profit-and-loss statements. Qualified third-party accountant bookkeeper or CPA Comfort Letter with associated Profit and Loss Statements and Balance Sheet documentation. The balance sheet provides a snap shot of business activity at a given moment.