Ace Prepare Financial Reports For Corporate Entities

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

This unit describes the skills and knowledge required to prepare financial reports for a reporting entity and encompasses compiling and analysing data and meeting statutory reporting requirements.

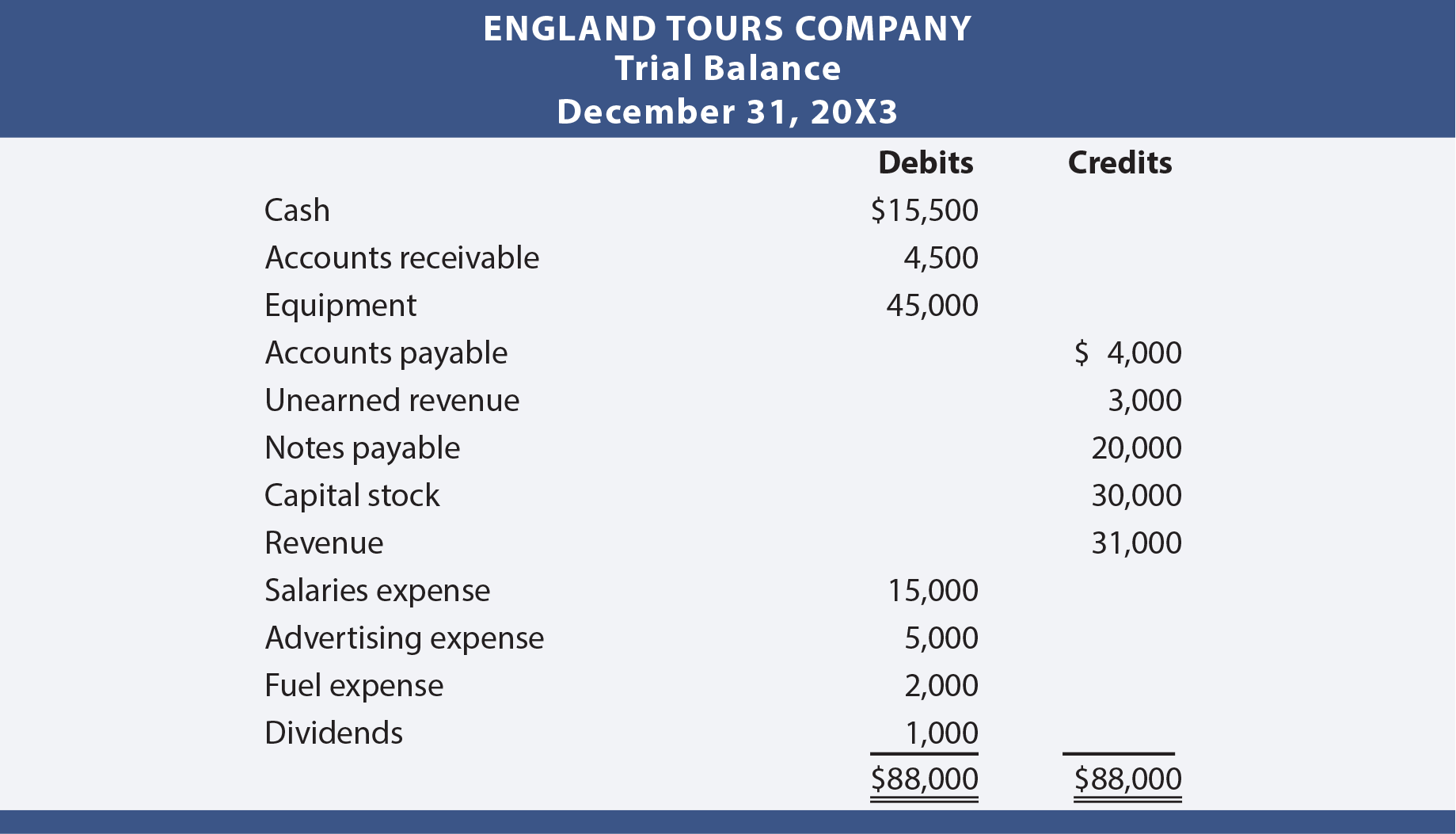

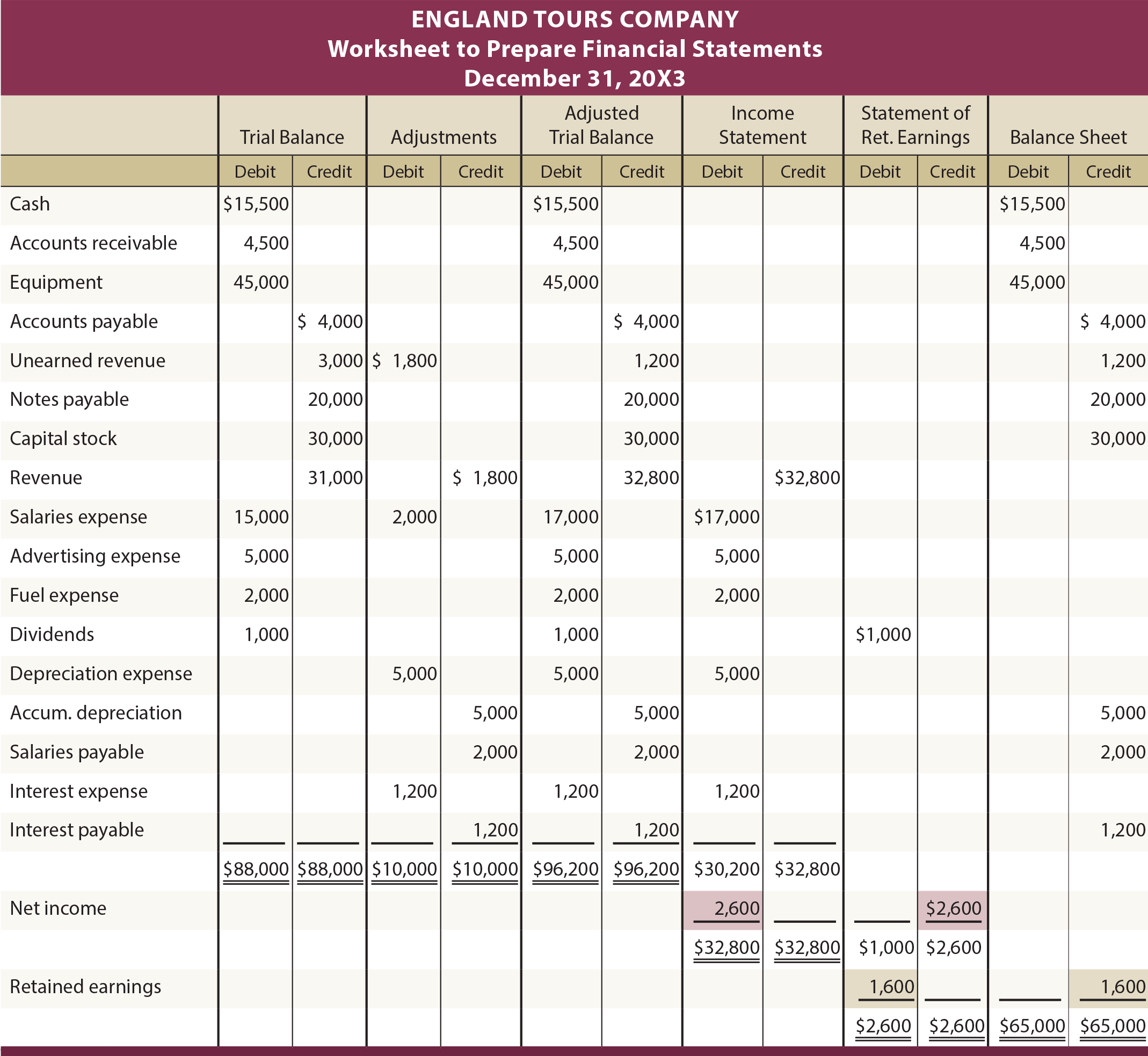

Prepare financial reports for corporate entities. Financial statements must be prepared within 3 working days of receipt of information from client. Reports aiding the acquisition of corporate entities. Financial summary at a specific point of time Includes.

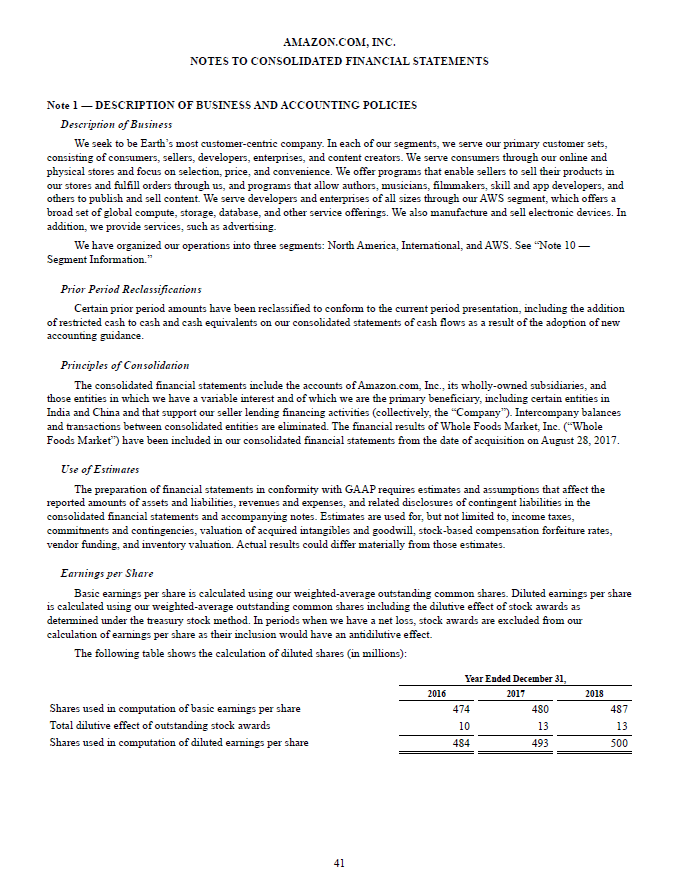

Accounting standards The accounting standards used by entities for preparing financial reports under the Corporations Law commonly referred to as AASB-series standards are made by the AASB a body established under Part 12 of the Australian Securities and Investments Commission Act 1989. Relevant accounting standards. Confirm data and reports comply with.

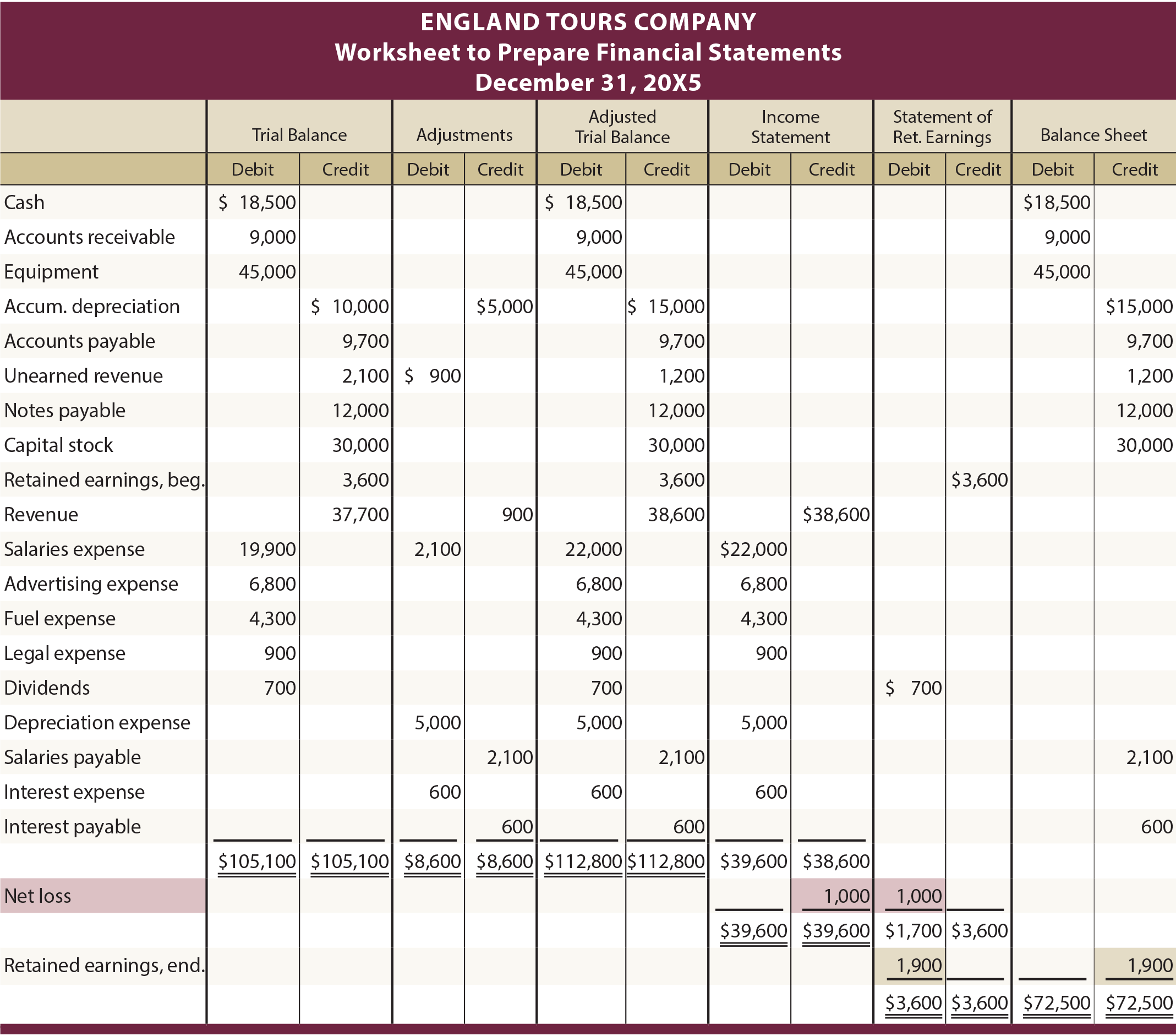

Automate your reporting with the acknowledged FPM Market Leading software from LucaNet. The report you have obtained is a general purpose financial report which must be prepared by all reporting entities Define a General Purpose Financial Report and what purpose it is used for. It encompasses compiling and analysing data and meeting statutory reporting.

Financial statements must be prepared as General Purpose Financial Statements according to AASB 101 Presentation of financial statements. If a specific volume or frequency is not stated then evidence must be provided at least once. And d all registered schemes.

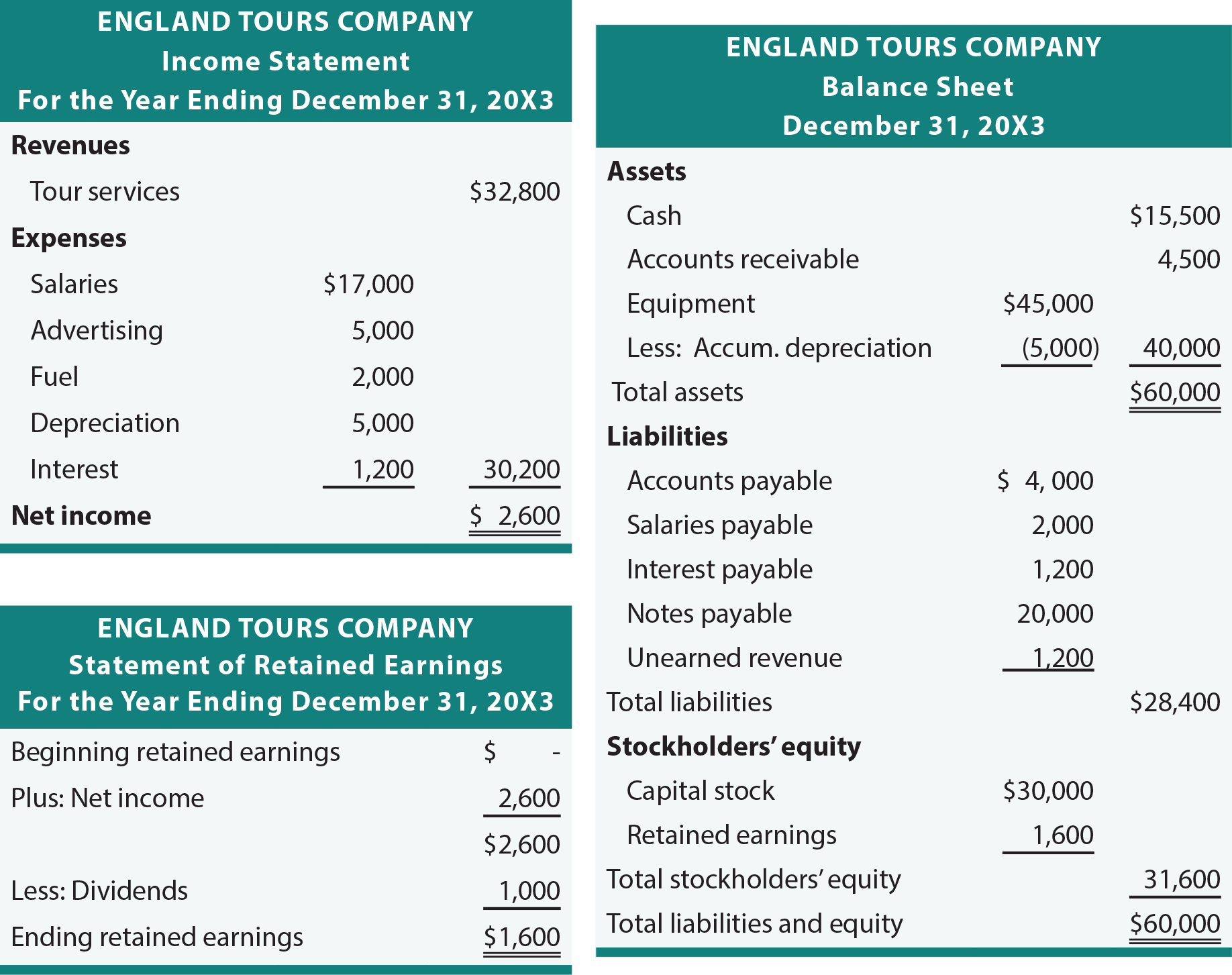

Nour QasemRahman The Principle of Reporting Balance Sheets or Statement of Financial Position. Here are the steps involved in creating an accurate and manifest finance report for a corporate. Ad Month-end manual processes by spreadsheet adds complexity and drains valuable resource.

The report you have obtained is a general purpose financial report which must be prepared by all reporting entities Define a General Purpose Financial Report and what purpose it is used for. Access and accurately compile data and prepare reports for corporate entities that comply with. Tax affected account reports.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)