Out Of This World Treatment Of Deferred Tax Asset In Cash Flow Statement

Increase in deferred tax asset will result as cash outflow so it will adjust as negative side.

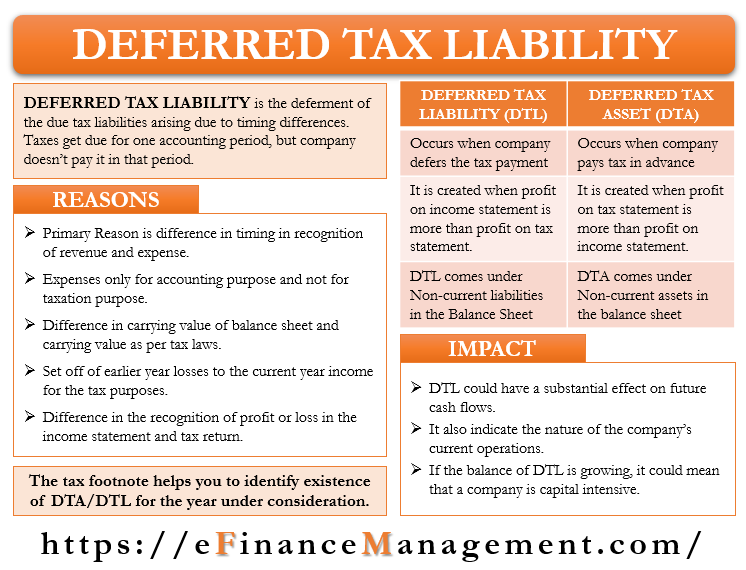

Treatment of deferred tax asset in cash flow statement. Assuming only noncash items are Depreciation of. So by analyzing this deferred tax helps in assessing where the balance is moving forward. Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice.

Deferred tax liability and cash flow statement. Future cash flow can be affected by deferred tax assets or liabilities. Proposed Dividend Previous Year.

Therefore it is not presented in the cash flow under the direct method. Accounting Treatment of the Proposed Dividend shall be as follows. This can be done by deducting the closing receivables balance from the opening receivables balance.

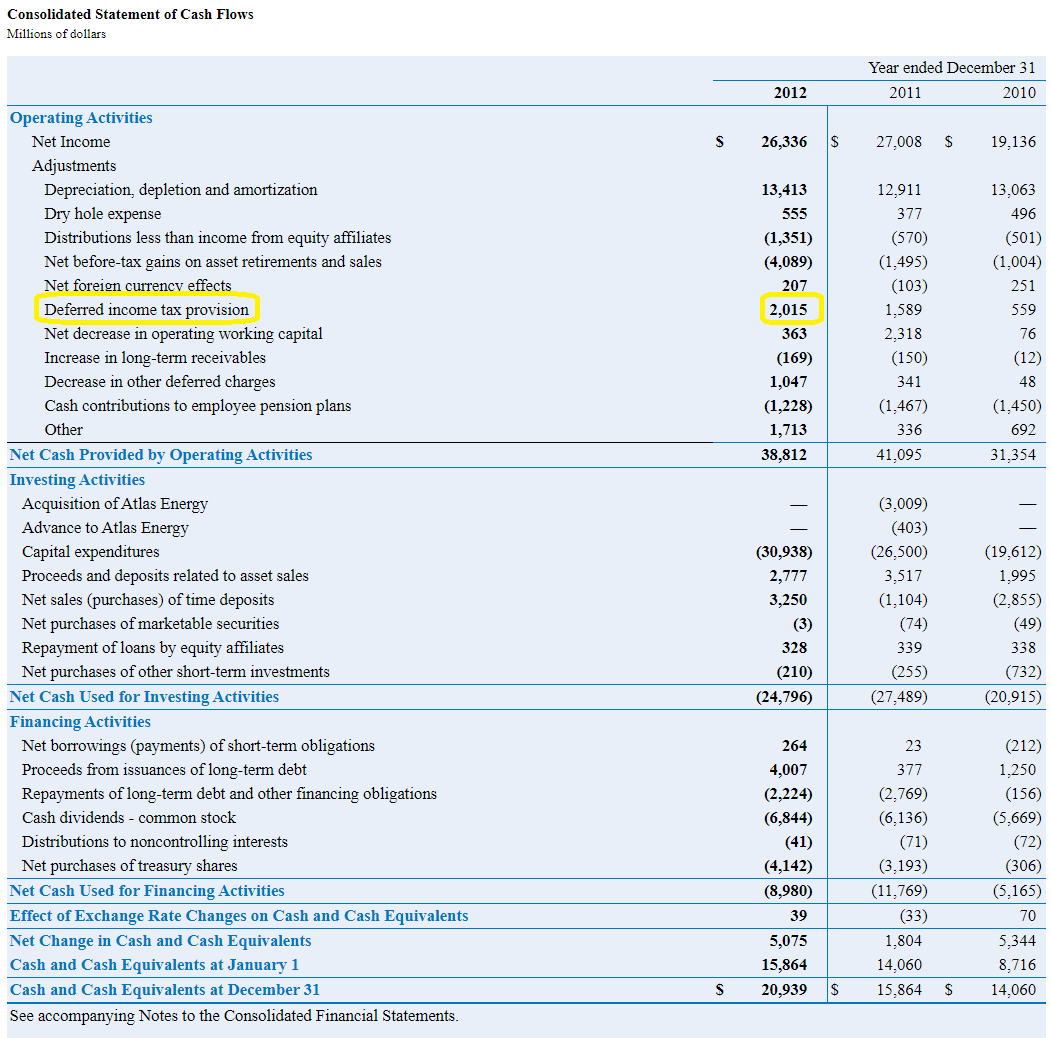

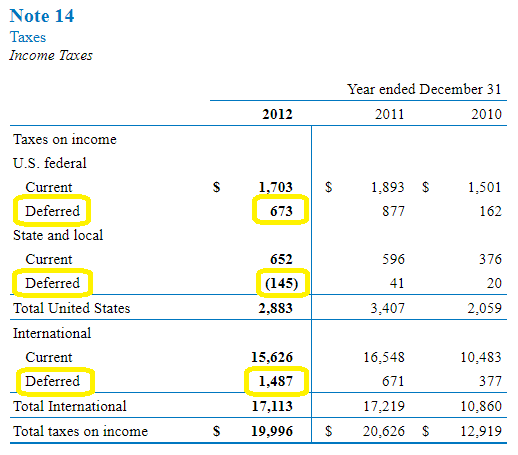

Say Suppose my PBT is 1000 and provision for tax is 180 and DTL is 20 then my PAT would be 800. If a deferred tax liability is increasing that means it is a source of cash and vice versa. Decrease in deferred tax assets.

Similarly deferred tax is a non-cash item and shall be treated accordingly in the operating activities section of the cash flow statement. Currency cash is a financial asset because it represents the medium of exchange and is therefore the basis on which all transactions are measured and recognised in financial statements. Avoiding pitfalls other issues.

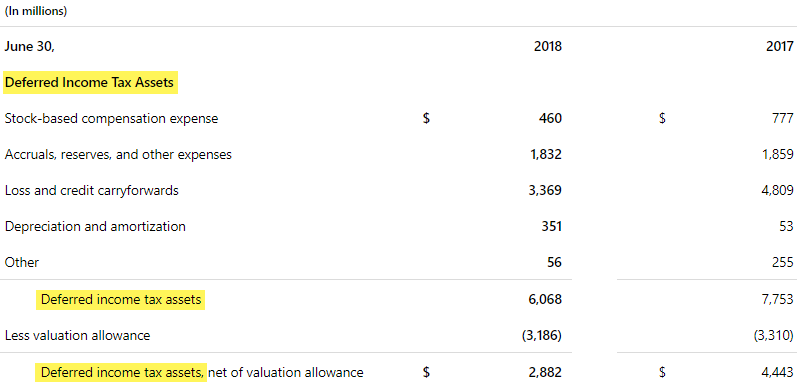

When preparing the statement of cash flows we deduct any increase in trade receivables in the period. Deferred tax assets are recognised only to the extent that recovery is probable. A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)