Unbelievable Relevant Financial Ratios

If current ratio is 2 or 21 it means we have twice.

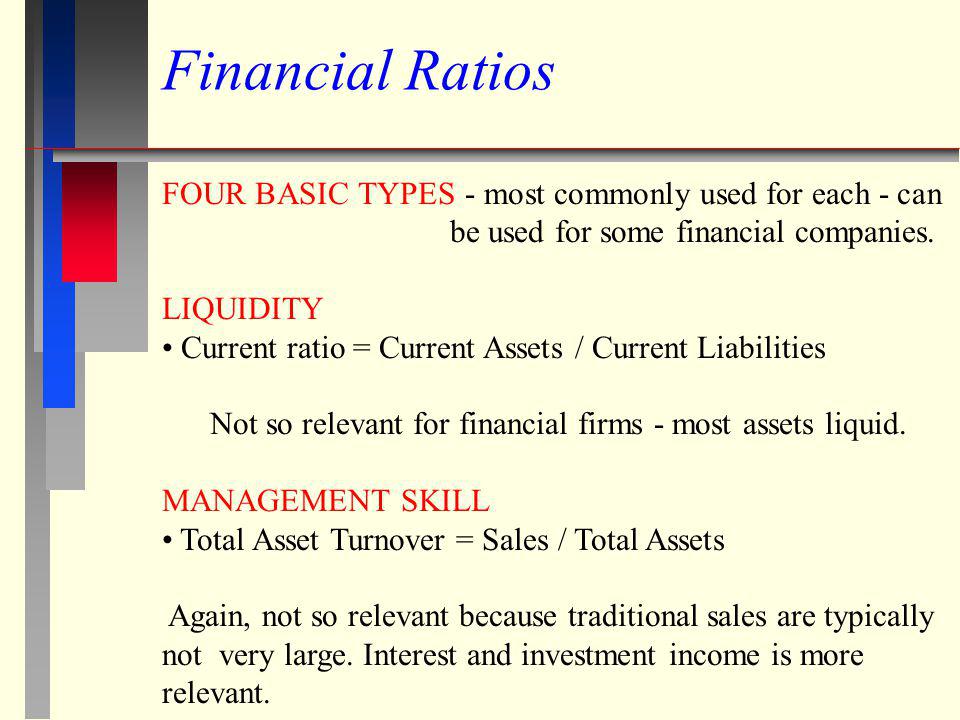

Relevant financial ratios. Ad Develop financial skills to unlock critical insights into performance. For instance in case of current ratio we compare current assets to current liabilities. These relationships between the financial statement accounts help investors creditors and internal company management understand how well a business is performing and of areas needing improvement.

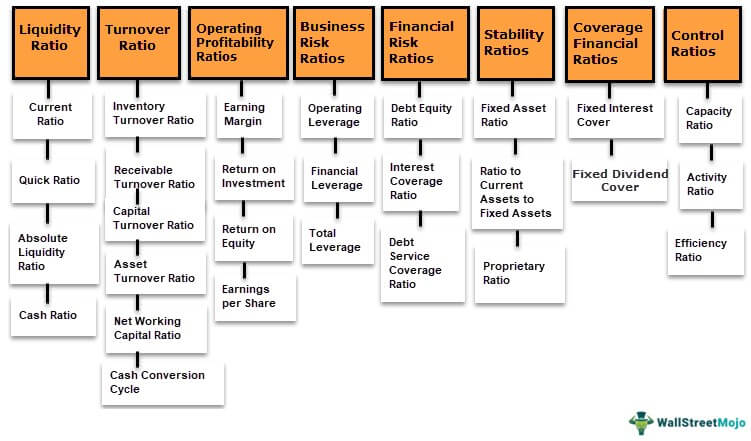

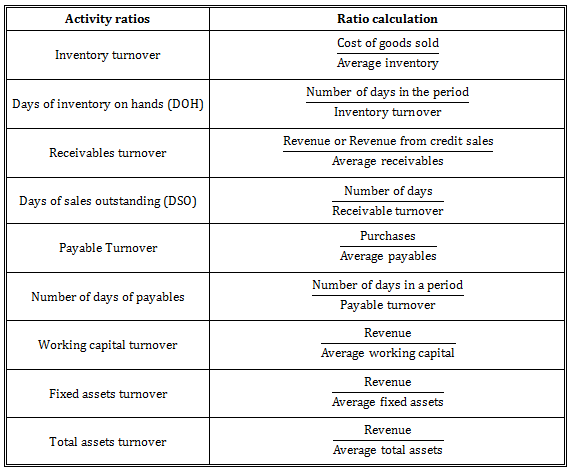

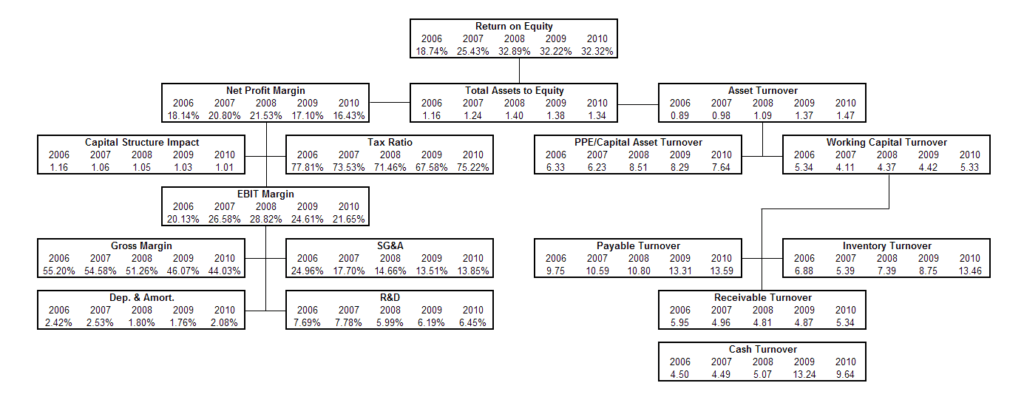

Ratios allow you to compare a various aspect of a companys financial. Financial ratios are the indicators of the financial performance of companies and there are different types of financial ratios which indicate the companys results its financial risks and its working efficiency like the liquidity ratio Asset Turnover Ratio Operating profitability ratios Business risk ratios financial risk ratio Stability. HBS Online offers a unique and highly engaging way to learn vital business concepts.

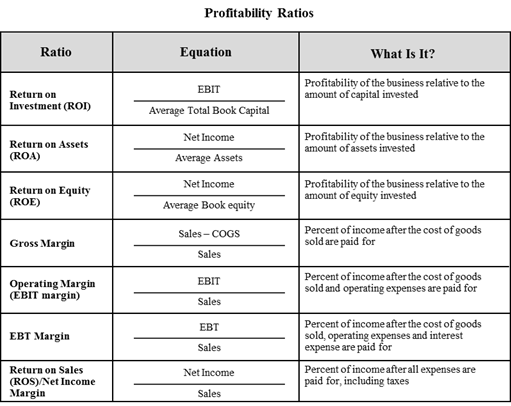

Operating profitability ratios 4. This ratio indicates the proportion of equity and debt used by the company to finance its assets. HBS Online offers a unique and highly engaging way to learn vital business concepts.

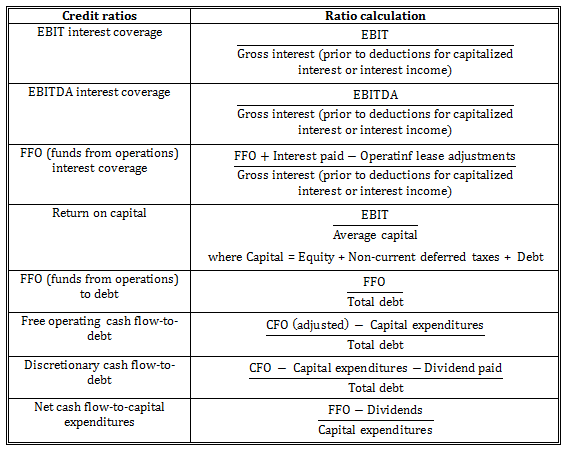

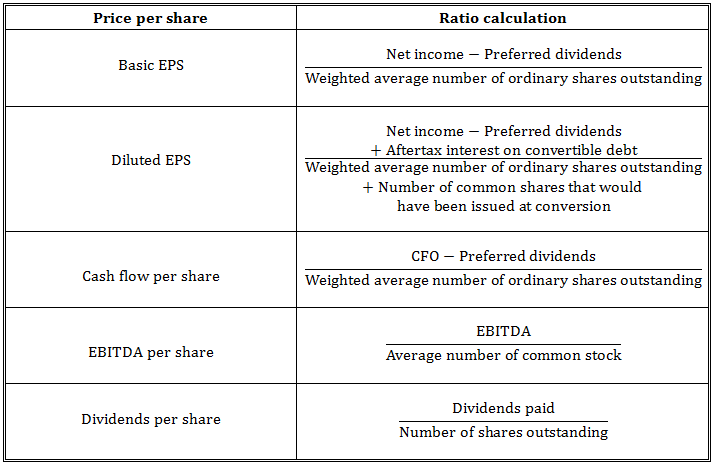

The debt-to-equity ratio is a quantification of a firms financial leverage estimated by dividing the total liabilities by stockholders equity. Financial risk leverage analysis ratios. The most cost commonly and top five ratios used in the financial field include.

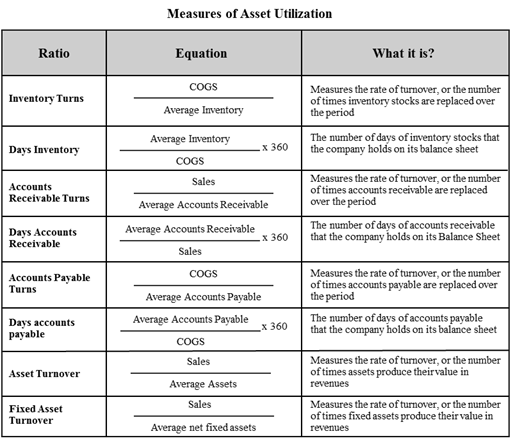

Operating efficiency ratios 3. Ad Develop financial skills to unlock critical insights into performance. Financial ratios can help understand the mind-boggling amount of data that can be found in a companys fiscal statements.

Knowing how to calculate and use financial ratios is important for not only businesses but for investors lenders and more. KEY FINANCIAL RATIOS The thorough valuation analyst will consider and compute five categories of ratios. Realizing how to select little bits of imperative data join them with other little bits of data and translate the subsequent number is a.