Sensational Salary Expense Appears On Which Financial Statement

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Most prepaid expenses appear on the balance sheet as a current asset unless the expense is not to be incurred until after 12 months which is a rarity.

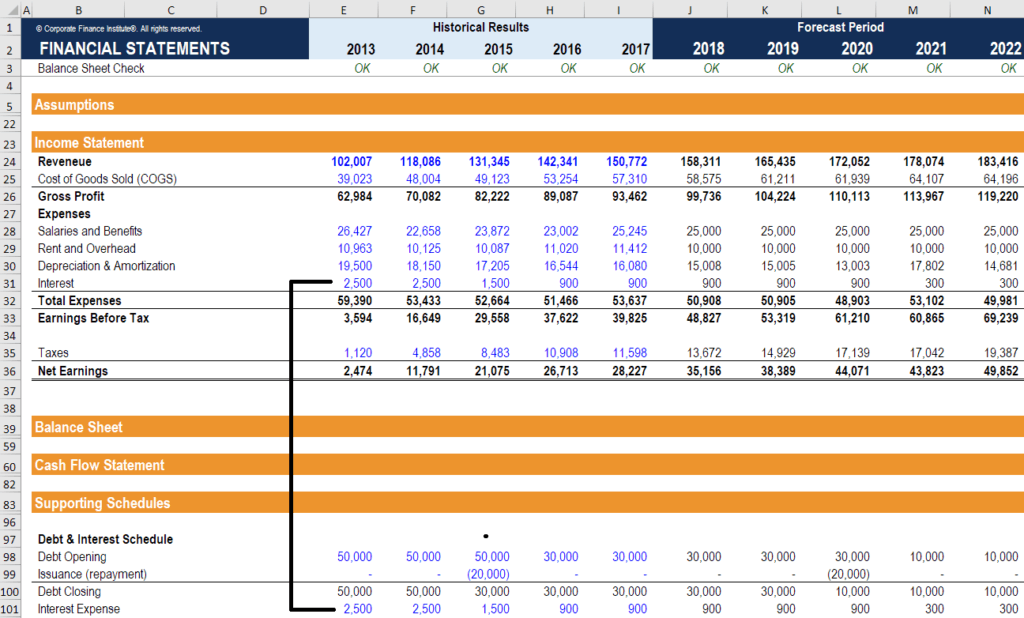

Salary expense appears on which financial statement. A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. How would the year-end adjusted entry recognize rent expense affect year 2 income statement and cash flows. Multiple Choice O Long-term liabilities section of the statement of stockholders equity Financing activities section of the statement of cash.

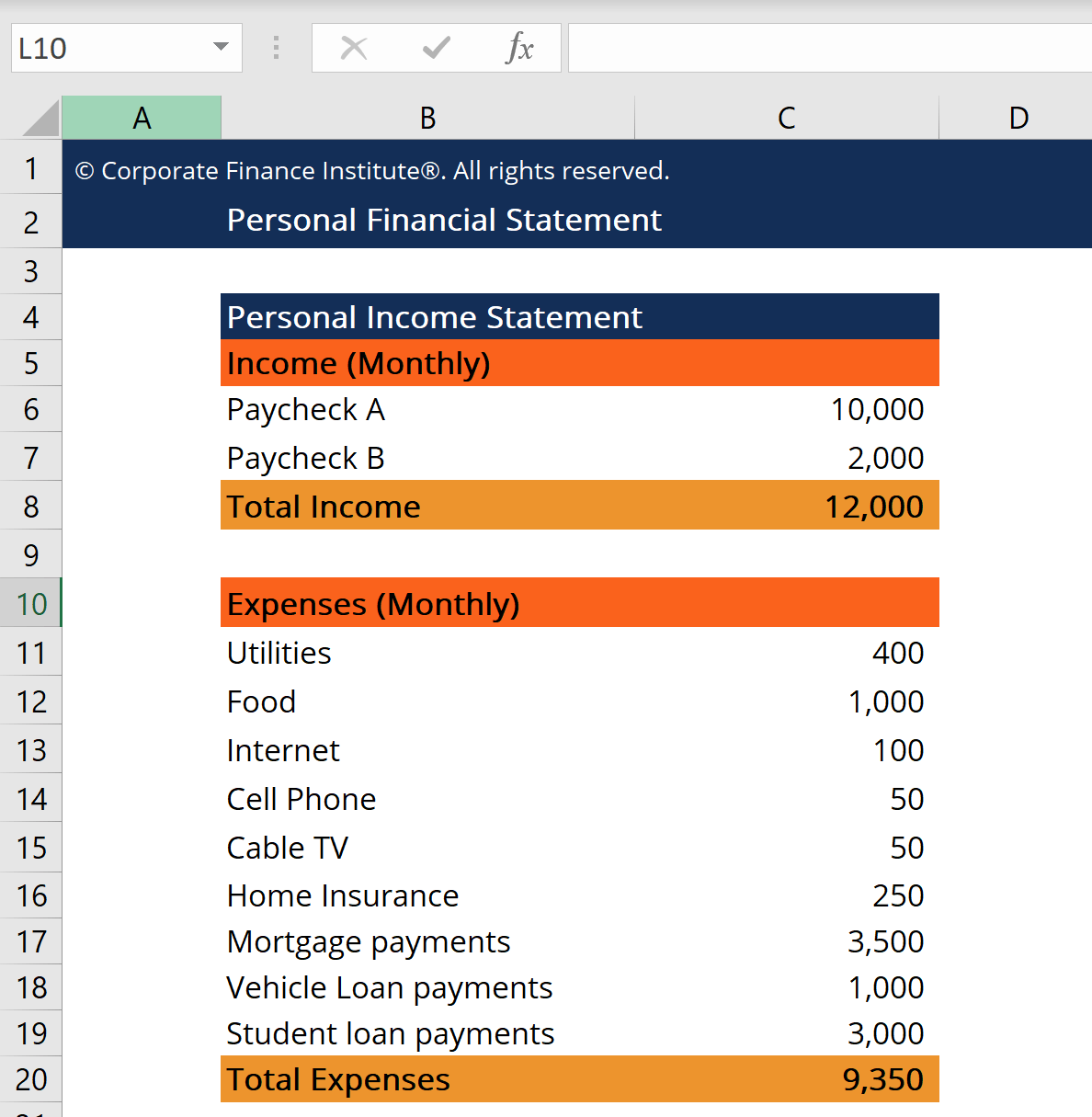

The income statement for a merchandiser is expanded to include groupings and subheadings necessary to make it easier for investors to read and understand. Financial statements are the means by which companies communicate their story. Salaries expense is the fixed pay earned by employees.

Then the company must show the salaries expense as a debit on the income statement. For Teachers for Schools for Working Scholars. Under the accrual method of accounting the amounts are reported in the accounting period in which the employees earn the salaries and wages.

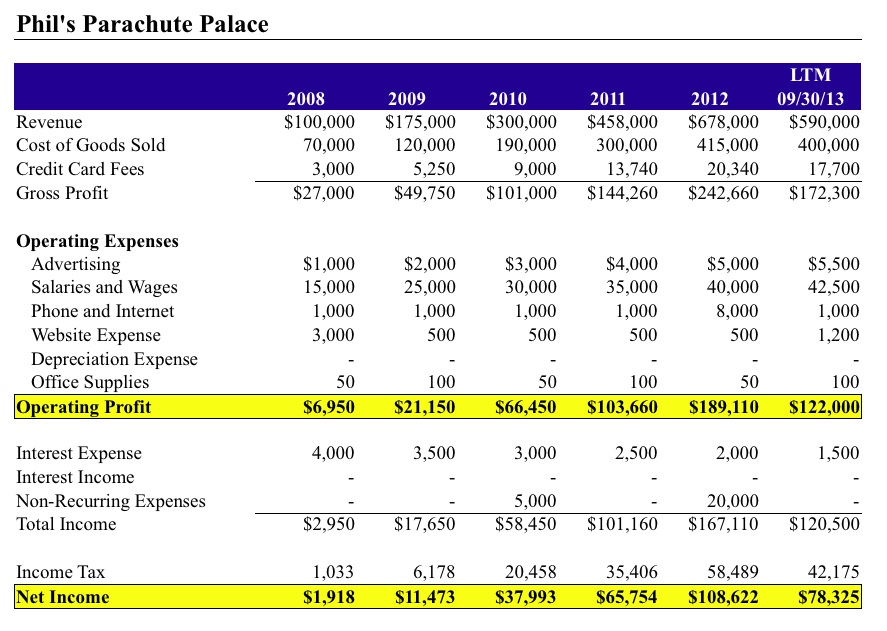

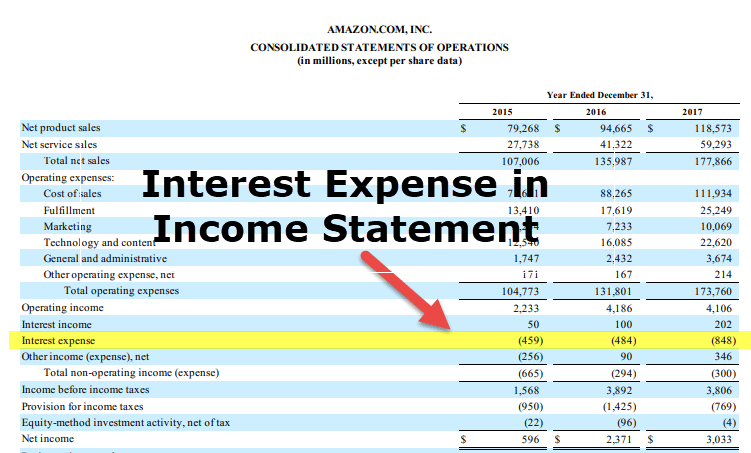

Salary and wages these are expenses need to be charged against income and in financial statement these are grouped under the head Employee Benefit Expenses and Finance Cost as per Part -II of Schedule III of the Companies Act2013 this is required for preparation of the financial statement of Pvt. Salaries and Wages as Expenses on Income Statement. But most firms that show an interest expense on their income statement do so because theyve borrowed money to fuel growth and to fund their operations.

Salary expense is the amount of wage that an employee earned during the period irrespective of whether it is paid or not. For example the salary of a waiter for a KFC branch after he serves for the whole month. Salary expense is listed with all other operating expenses on the Income Statement or Profit Loss Statement.

It may be referred to as Wages and Salaries or Payroll Expense. Company however for those entity where this Schedule III is not required to be followed there Salary which is directly related to the activity shown as direct expenses. Multiple Choice O Prepaid supplies unearned revenue accounts payable O Accounts payable equipment prepaid Insurance O Cash prepaid rent accounts receivables Common stock prepaid rent notes payable Cash from the sale of common stock appears in the.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)